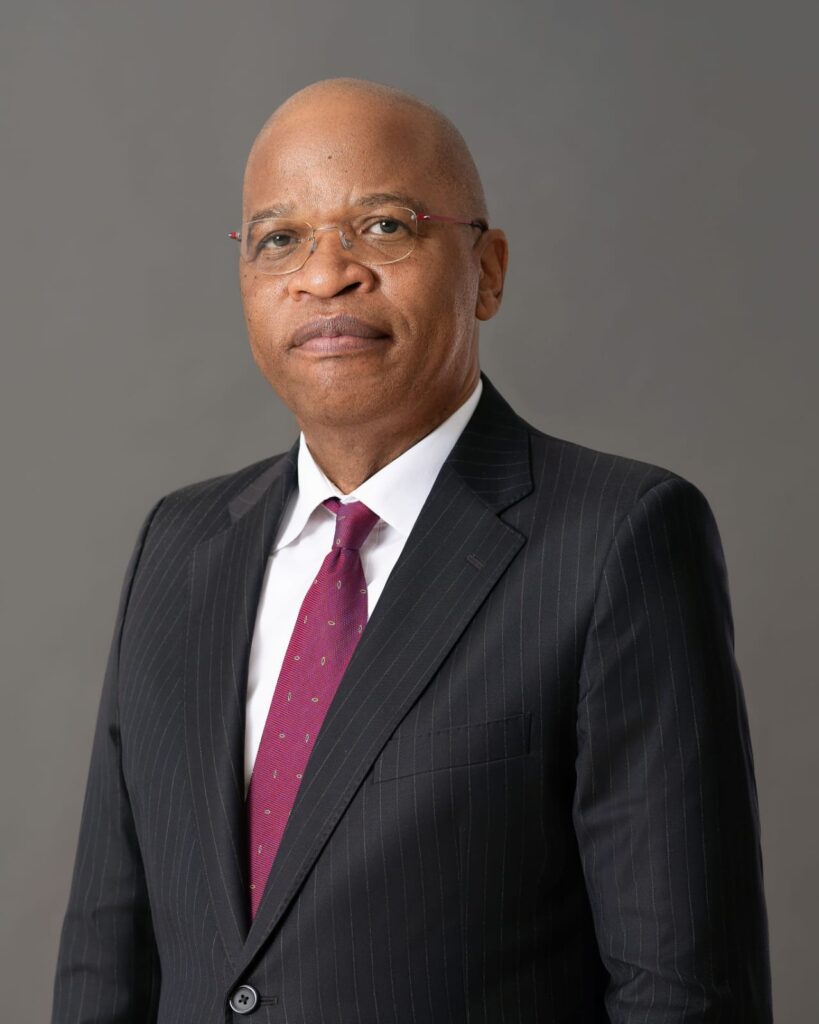

By: John Lamola

One of the unnoticed but burgeoning trends in the air passenger transportation industry is the increasing number of airline codeshare agreements that are being signed.

There is no doubt that co-operative alliances are the future of the aviation industry which is only just starting to recover from the setbacks of the COVID-19 pandemic.

Research by McKinsey Consultancy provides ample evidence for the necessity of the codeshare partnerships. This sobering study says in part: “Although the COVID-19 pandemic hit airlines harder than any other aviation subsector, the industry was not doing particularly well before then. From 2012 to 2019, despite a favourable environment of strong economic growth and low fuel prices, airlines were bleeding on average $17 billion in economic profit a year. But the average losses of airlines before the pandemic were only around one-tenth of their $168 billion in losses for 2020. Their revenues plummeted by 55 percent, setting the subsector back, in nominal terms, roughly 16 years—to 2004.”

To survive airlines, have no option but to look for strategic partnerships that will help extend reach, while allowing airlines to concentrate on routes that serve their passengers optimally both efficiently and profitably.

SAA has codeshare agreements with Emirates, Air Mauritius, LAM Mozambique, Egyptair, Ethiopian, Singapore Airlines and Kenya Airways. Our priced customer offering in this context is SAA’s member of the 24 member airlines network, Star Alliance, which prides itself as being the world’s largest global airline alliance.

In addition, SAA has entered into a unique and ambitious partnership framework agreement with Kenya Airways. This partnership entails an active code share and cooperation on aircraft maintenance services.

In this month of September SAA will be celebrating a full year of returning to the skies after exiting business rescue.

The market we now operate in is markedly different to the one we were forced to exit at the beginning of 2020. The landscape of the South African domestic market has changed radically as SAA is no longer the dominant carrier. On the other hand, operating costs are higher driven by the impact of uncontrollable global political and social uncertainty, resulting in havoc with jet fuel pricing

Our tactical response has been to be innovative in reclaiming our slice of market share, by concentrating on high-demand local routes – Cape Town and Durban –a a carefully selected – continental routes where passenger numbers remain encouraging.

Our international routes expansion strategy is primarily focused on codeshare agreements and alliances that gives SAA passengers effortless access to many international destinations. We are encouraged by the ability afforded our passengers to reach more destinations with our code share partners and Star Alliance network

We are also excited at the ongoing processes in the South African government that are aimed at freeing SAA from being a State-run airline. SAA is currently evolving into an agile airline with an operating model that can secure its financial sustainability, independent of the fiscus.

For the airline’s survival and growth, SAA management is seized with the crafting of a robust route network strategy, selection of the right technology at right prices, meticulous market movement forecasting, effective marketing and branding campaigns, and most important, strong strategic alliances.

This has become SAA’s driving focus as we celebrate our re-birthday month.

*Professor John Lamola is the interim Chairman and Chief Executive at SAA